Blue Coin Predictions for 2026

Why 2025 delivered the most important year of institutional, regulatory, and market-infrastructure advances in crypto history and what it means for investors in 2026.

2025 Overview

Given the level of optimism heading into 2025—a decisively pro-crypto U.S. administration, Gary Gensler’s resignation, and growing expectations for monetary easing—bitcoin’s roughly 25% appreciation since the presidential election may feel, at first glance, somewhat underwhelming.

It calls to mind Peter Thiel’s oft-quoted observation: “They promised us flying cars, and all we got was 140 characters.”

That framing, however, risks obscuring the magnitude of what did occur beneath the surface. On the positive side, BTC, ETH, SOL, and XRP each reached new all-time highs ($126,080, $4,946, $293, and $3.65, respectively), driven by sustained institutional demand and an unprecedented wave of favorable regulatory developments. Stablecoins and tokenization entered the mainstream financial lexicon. Major wirehouses, including Morgan Stanley and Merrill Lynch, enabled client access to spot crypto ETFs. The public markets also welcomed a new cohort of large-scale crypto IPOs, with companies such as Circle, Figure, and Gemini coming to market at multibillion-dollar valuations.

At the same time, the year was not without meaningful setbacks. Crypto majors—including all four assets referenced above—retraced sharply from their highs and ended the year with negative performance. Many smaller-capitalization tokens declined by 50% or more. This drawdown was compounded by a convergence of factors: concerns around a potential “down year” in Bitcoin’s historical four-year cycle, evidence of long-term holder selling, increased attention on long-dated technological risks such as quantum computing, and a more challenging macroeconomic backdrop. Together, these dynamics weighed heavily on market sentiment.

In our view, while price performance may have fallen short of elevated expectations, 2025 delivered more structural progress than any year in crypto’s history. The foundations laid through institutional adoption, market infrastructure, and regulatory clarity are both deep and durable.

We believe this structural progress will ultimately prevail, and we remain constructive on the outlook for 2026. The long-term trajectory of the asset class appears too powerful—and too well supported—to be meaningfully derailed.

Predictions & Investing Themes for 2026

As we look ahead to 2026, we believe the crypto asset class is entering a phase where outcomes will be driven less by narrative and more by execution, adoption, and measurable progress. With that framework in mind, we have outlined five forward-looking predictions that we believe will shape market structure, capital flows, and relative asset performance over the coming year. For each prediction, we describe how it can be objectively evaluated, the implications for risk and return, and—where appropriate—the positioning or actions we are taking within the Blue Coin Fund to capitalize on these developments. To ensure accountability and transparency, we will revisit these forecasts at year-end and publish a scorecard assessing each prediction against clearly defined criteria.

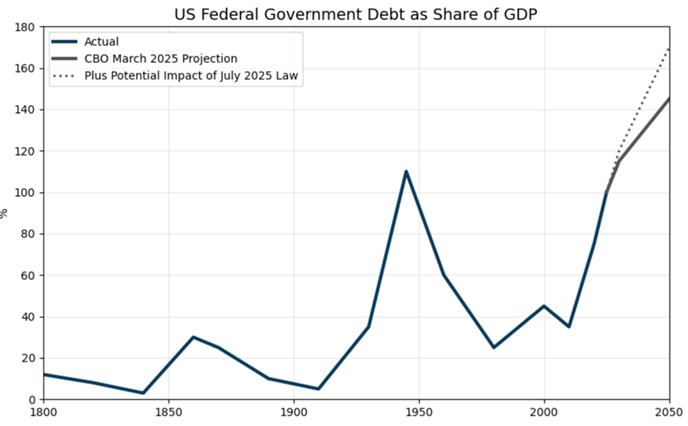

1. Dollar Debasement Risk Accelerates Demand for Alternative Monetary Assets

We expect continued expansion in both the U.S. money supply and federal indebtedness, with positive implications for real asset pricing and digital assets in particular. Despite periodic rhetoric around fiscal discipline, structural deficits, rising entitlement obligations, and higher interest expense suggest that U.S. government debt as a share of GDP is likely to continue its upward trajectory. In parallel, we anticipate renewed growth in M2 as financial conditions ease and policymakers prioritize economic stability over balance-sheet contraction. Historically, sustained increases in liquidity and sovereign leverage have served as a powerful tailwind for scarce and non-sovereign assets, as investors seek stores of value that are insulated from currency debasement and fiscal dilution. In this context, we view bitcoin—and, selectively, other crypto assets with strong monetary or settlement characteristics—as increasingly relevant macro assets rather than purely speculative instruments.

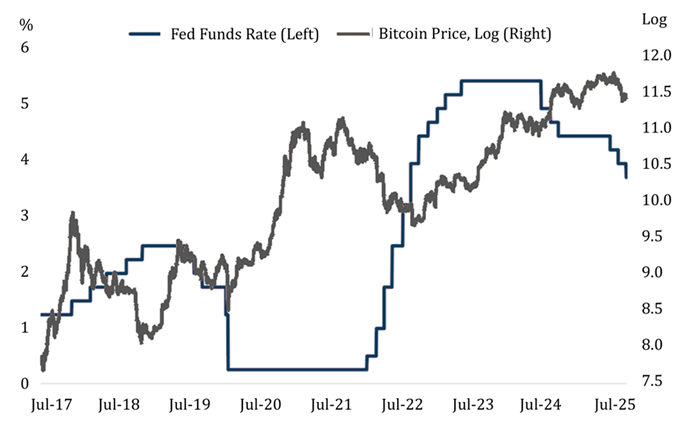

Alongside rising government debt and money supply, we expect further rate cuts in 2026. Historically, expectations of easier monetary policy have supported bitcoin and other crypto assets, as illustrated in the chart below, by improving liquidity and lowering the discount rate applied to scarce, long-duration assets.

Prediction: As of November 2025, the U.S. M2 money supply stands at approximately $22.3 trillion. Total federal debt—including debt held by the public and intragovernmental holdings—now represents roughly 120% of GDP as of December 2025. We expect both measures to trend higher by year-end. In addition, the federal funds target range currently sits at 3.50% to 3.75%, and we anticipate lower policy rates by the end of the year.

Portfolio positioning: In light of our expectations for continued expansion in the U.S. money supply, rising federal debt relative to GDP, and additional Federal Reserve rate cuts, we are intentionally maintaining a low cash balance within the fund. This positioning is designed to ensure full participation in a potential crypto bull market as we move into 2026.

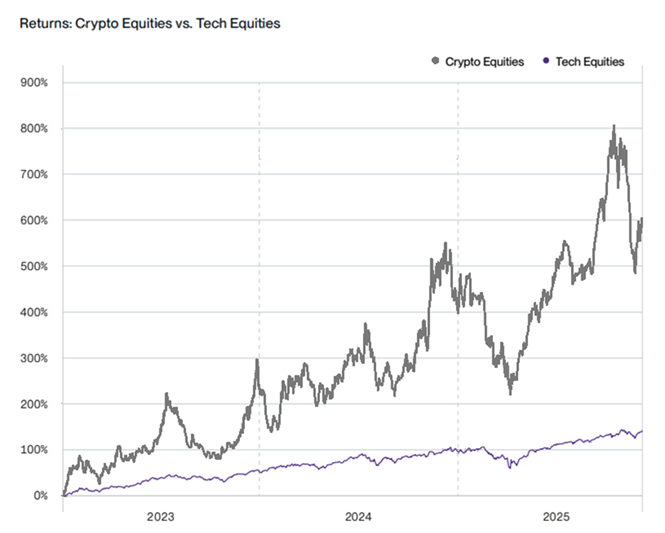

2. Crypto Equities Will Outperform Tech Stocks

Over the past three years, tech equity investors have enjoyed strong performance, with roughly 140% cumulative returns. Crypto equity investors, however, have seen materially stronger results. The Bitwise Crypto Innovators 30 Index, which tracks publicly traded companies providing the core infrastructure and services for digital assets, is up approximately 585% over the same period.

We believe this divergence is only beginning. Regulatory clarity from Washington is improving the operating environment for compliant crypto firms, enabling innovation and expansion. Initiatives such as Coinbase’s renewed focus on token issuance and Circle’s launch of a Layer-1 blockchain underscore this momentum. We expect 2026 to be a breakout year for crypto equities.

Prediction: Over 2026, the Bitwise Crypto Innovators 30 Index will outperform the Nasdaq-100 Index.

Portfolio Positioning: We are planning to allocate opportunistically to crypto equities such as Coinbase.

3. Prediction Markets Will Double in 2026

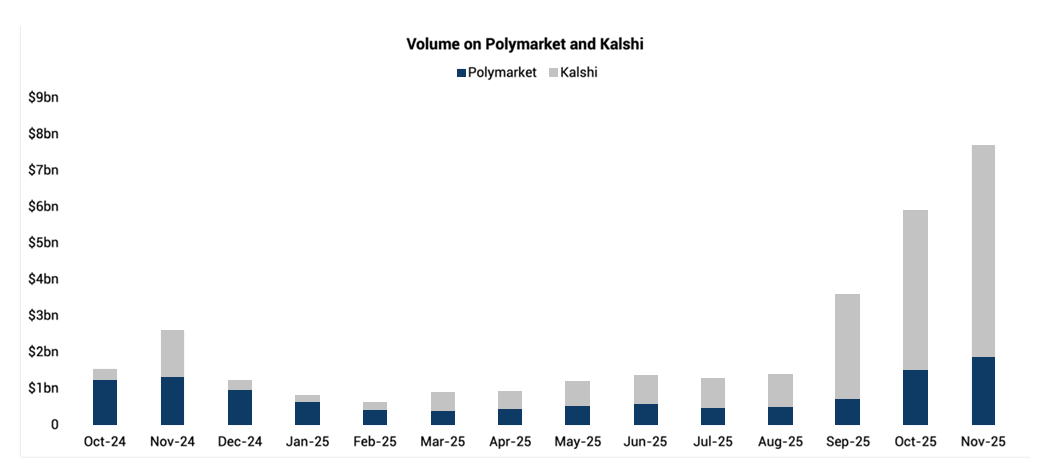

2025 marked the rise and growing regulatory acceptance of prediction markets—platforms that allow participants to express views on real-world outcomes through event-based contracts that pay winners the full contract value and losers nothing. While volumes slowed after the November 2024 U.S. election, that cycle introduced prediction markets to a much broader audience. Monthly active traders on Polymarket and Kalshi increased post-election as users remained engaged with newly listed markets, despite lower aggregate trading volumes.

During 2025, the sector also made meaningful regulatory progress. CFTC oversight of event-based contracts provided a clearer federal derivatives framework, enabling platforms such as Kalshi and Polymarket to expand their offerings and move further into the mainstream. Coinbase has taken strategic steps into prediction markets as part of its “everything exchange” strategy, including a partnership with Kalshi to operate within an established regulated framework.

Looking ahead to 2026, we expect prediction markets to play a central role in forecasting the U.S. midterm elections and to outperform traditional political punditry. While insider trading remains a debated issue, we believe non-government participation will ultimately be permitted to enhance price discovery.

Prediction: Combined monthly volume on Polymarket and Kalshi reaches $16 billion in 2026.

Portfolio Positioning: We plan to allocate opportunistically to Coinbase to gain exposure to prediction markets.

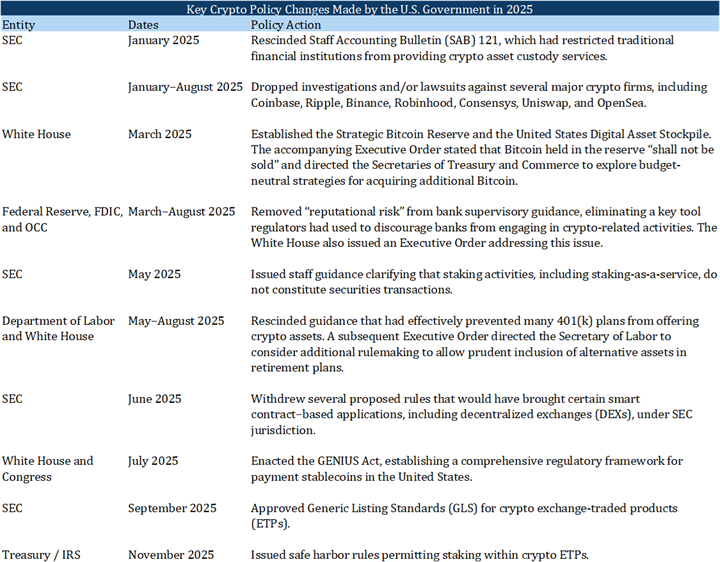

4. Regulatory Clarity Accelerating Digital Asset Adoption

The United States made meaningful progress toward crypto regulatory clarity in 2025, including passage of the GENIUS Act on stablecoins, the rescission of SEC Staff Accounting Bulletin 121 on custody, the introduction of Generic Listing Standards for crypto ETPs, and improved access to traditional banking for the digital asset industry. In 2026, we expect another major milestone with bipartisan market structure legislation. The House passed its version in July, known as the Clarity Act, and the Senate has since advanced its own framework. While details remain under negotiation, the legislation broadly establishes a traditional finance rulebook for crypto capital markets, including registration and disclosure standards, asset classifications, and insider rules.

A comprehensive regulatory framework across the U.S. and other major economies would enable regulated financial institutions to hold digital assets on balance sheet and transact directly on-chain. It would also unlock regulated on-chain capital formation, allowing both startups and established firms to issue compliant tokens. We believe this environment will materially benefit ETH and SOL and could drive the native tokens of both networks to new all-time highs if market structure legislation passes in 2026.

Prediction: Market structure legislation is enacted, and ETH and SOL reach all-time highs.

Portfolio Positioning: Overweight DeFi assets such as LINK and SYRUP, with meaningful allocations to ETH and SOL.

5. Long-Tail Risk: Stablecoins Blamed for Destabilizing a Developing Country

In 2026, several developing countries with independent currencies face acute risks of currency destabilization due to the rise of USD-backed stablecoins. Factors like high inflation, FX shortages, capital controls, and low trust in banks drive citizens toward dollar-pegged tokens (USDT, USDC) as alternatives to volatile local money. At the same time, crypto adoption has surged via mobile wallets and peer-to-peer networks, enabling “digital dollarization” that can hollow out monetary sovereignty. A combination of economic vulnerabilities and stablecoin penetration put several countries at risk, including Argentina, Nigeria, Turkey, Lebanon, Venezuela, Zimbabwe, Iran, Pakistan, Egypt and Kenya. For countries with weak currencies, stablecoins act as a monetary black hole — pulling domestic liquidity into the dollar system at the speed of the internet.

Prediction: This outcome is difficult to quantify, but we expect at least one major news outlet will publish an article in 2026 linking stablecoin adoption to the destabilization of a developing-country currency.

Portfolio Positioning: no action

In closing, while near-term volatility remains a defining feature of the digital asset market, we believe the long-term investment case for crypto has never been stronger. The convergence of institutional adoption, regulatory clarity, and macroeconomic tailwinds is reshaping crypto into a durable macro asset class. As always, we remain focused on disciplined execution, risk management, and capturing the most compelling opportunities for our investors in the year ahead.

If you encounter a paywall on any of the linked resources, feel free to reach out—I’d be happy to share the full content.

If you found this newsletter valuable, please consider sharing it with others.

Mike Treidl, CFA | Founder & CIO @ Blue Coin Capital

Disclosures & Disclaimers

The information contained in this newsletter is for informational purposes only and does not constitute investment, legal, or tax advice. Blue Coin Capital is an investment adviser that manages digital asset strategies for qualified investors. Nothing herein should be interpreted as an offer to sell, or a solicitation of an offer to buy, any securities or investment products.

Opinions expressed are current as of the date of publication and subject to change without notice. Certain content may reflect the views of Blue Coin Capital and its personnel and may include forward-looking statements that are not guarantees of future performance.

Digital assets, including cryptocurrencies and stablecoins, are speculative and involve a high degree of risk. Past performance is not indicative of future results. Always conduct your own research and consult with a qualified professional before making any investment decisions.

Blue Coin Capital, LLC is a California limited liability company.