From Bonds to Blockchain: Understanding DeFi Yields

Summary

In the rapidly evolving world of decentralized finance (DeFi), yield generation has become both an art and a science—blending traditional financial mechanics with cutting-edge blockchain innovation. From Treasury-backed stablecoins and on-chain money market funds to lending protocols, synthetic dollars, and composable “yield loops,” investors today can earn returns once reserved for Wall Street institutions—all through transparent, programmable systems that run 24/7.

But how exactly do these yields arise, and what risks accompany them? This post breaks down the building blocks of DeFi yields and explores how they’re reshaping the future of digital finance.

Treasury Backed Stablecoins & On-chain Money Market Funds

The first building block of DeFi, and one of the simplest ways yield is generated in decentralized finance today, involves stablecoins and on-chain money market funds backed by short-term U.S. Treasuries. In these structures, the yield earned from the underlying Treasury securities effectively flows through to the end user, providing a return similar to holding a money market fund. While the GENIUS Act, passed earlier this year, prohibits payment stablecoin issuers from directly passing along interest to holders, some issuers have introduced alternative mechanisms to effectively mimic an interest-bearing structure without violating current regulations.

Beyond stablecoins, several on-chain products now bridge traditional Treasury yields with blockchain accessibility—often marketed as tokenized money market funds or Treasury-backed tokens. Examples include:

Franklin Templeton’s OnChain U.S. Government Money Fund (FOBXX), one of the first registered U.S. mutual funds to record ownership on a public blockchain, demonstrating how regulated managers are beginning to tokenize traditional fixed-income products.

BlackRock’s BUIDL Fund – A tokenized institutional fund launched in partnership with Securitize that invests in U.S. Treasuries and repurchase agreements, distributing yield directly to investors’ digital wallets on the Ethereum blockchain.

On-chain money market funds such as BUIDL and FOBXX are SEC-regulated investment products that explicitly distribute Treasury-backed income to investors, whereas payment stablecoins are digital dollars designed for transactions and regulated like payment instruments that cannot explicitly pass through yield. These products represent a growing category of “real-world assets” (RWAs) on-chain—offering familiar Treasury exposure and institutional-grade yield, but with 24/7 blockchain settlement, programmability, and global investor access. These yields are highly dependent on short term treasury rates and currently yield between 4.0% to 4.5% APY.

Lending and Borrowing Protocols

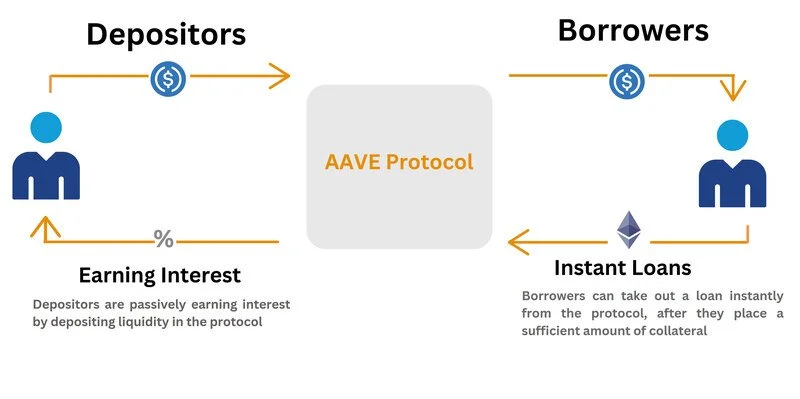

The second building block of DeFi is lending and borrowing protocols. These protocols function much like a securities/margin lending desk where investors lend cash or securities to borrowers who post collateral against the cash they are borrowing. Interest accrues dynamically, and collateral is monitored and marked-to-market.

At their core, these protocols (such as Aave and Compound) use smart contracts to match borrowers and lenders automatically, without intermediaries. When an investor deposits a stablecoin like USDC, that capital becomes part of a liquidity pool from which borrowers can draw. Borrowers must overcollateralize their loans (typically posting more crypto value than they borrow), ensuring the system remains solvent even during market volatility.

The yield earned by the lender comes from the interest paid by borrowers, similar to how a traditional bank pays depositors from loan revenue. In periods of strong demand for leverage—when traders borrow stablecoins to buy ETH or BTC, or institutions use them for liquidity management—interest rates rise in real time, and depositors’ yields increase accordingly. This type of activity carries distinct risks, including smart contract vulnerabilities, collateral volatility, and liquidity shocks if many users attempt to withdraw simultaneously.

In essence, lending protocols allow investors to earn yield by providing credit to a decentralized market, much like institutions earn interest by participating in overnight repo or securities lending—only here, the trust and enforcement mechanisms are encoded in blockchain software rather than intermediated by banks or clearinghouses. These yields depend significantly on supply and demand and at the time of publication are currently yielding 3.8% APY to supply USDC and 5.4% APY to borrow USDC.

Lenders of USDC sometimes earn less of a yield using Aave than on the risk-free rate earned on short-term U.S. Treasuries. The reason for this is a combination of several beneficial factors, including the immediate liquidity of withdrawing USDC from Aave, the composable nature of the deposit (discussed later), the absence of KYC (Know Your Customer) requirements, universal accessibility to anyone with an internet connection, and the 24/7 availability of the platform.

In addition to the permissionless protocols mentioned above, there are blockchain-based institutional credit platforms like Maple Finance, a DeFi version of a private credit fund, that connects accredited lenders with vetted institutional borrowers through on-chain loan pools. Institutional borrowers pay higher interest rates to Maple than they would otherwise pay to a permissionless protocol to ensure a steady line of credit, with fixed interest rates over a fixed period. This additional yield is passed on to the lender, and currently provides a yield of 6.5% APY.

Synthetic Dollars & Perpetual Futures Funding Rate Arbitrage

Synthetic dollars are a new class of stablecoins that maintain their peg to the U.S. dollar without holding Treasuries or other real-world assets. Instead, they achieve price stability through crypto-native hedging strategies: purchasing a cryptocurrency such as ETH and then taking an offsetting position in perpetual futures to neutralize price risk. This delta-neutral structure allows the synthetic dollar to stay near a 1:1 value with USD, effectively replicating the stability of fiat-backed stablecoins—only through derivatives rather than cash reserves. To grasp how this works, it helps to first understand how perpetual futures and their funding rate mechanics operate.

In crypto derivatives markets, perpetual futures (or “perps”) are contracts without expiry. To keep their price tethered to the spot, exchanges use a funding rate mechanism:

If the perpetual trades above spot, longs pay shorts (positive funding).

If the perpetual trades below spot, shorts pay longs (negative funding).

Because market participants tend to favor long exposure (i.e. more demand for upside via leverage), in many market regimes funding rates are persistently positive, meaning shorts receive payments from longs.

An example of a classic arbitrage strategy used to profit from this funding rate goes like this:

Go long (buy) the spot asset (e.g. ETH).

Go short (sell) the perpetual futures on ETH (delta neutral hedged).

Earn the funding payments from the short side, while isolating the price fluctuations of ETH.

This is analogous to a carry trade in FX or a cash-and-carry basis trade in commodities: you hold the underlying while shorting futures, capturing the spread (or in this case, funding) when conditions persist.

USDe is Ethena’s synthetic dollar: a stablecoin (or synthetic stable asset) that aims to stay pegged to USD without using fiat backing. Instead of being backed by USD, USDe is backed by an equivalent amount of ETH and a short perp, using delta neutral hedging to keep the combined value stable. Staked USDe (sUSDe) is the “yield bearing” version of USDe. You stake USDe → receive sUSDe, and yields (from the funding rate) accrue to sUSDe holders. In effect, USDe is the “liquid” synthetic stable asset, and sUSDe is the yield-bearing version. Currently, yields from staked USDe are around 8% APY.

Staking in crypto is the process of locking up digital assets to help secure a blockchain network—typically a proof-of-stake system—in exchange for earning rewards or yield.

Composability & Yield Looping

This is where DeFi truly gets interesting. One of its most powerful features is composability—the ability to connect protocols like Lego bricks, where each piece can snap together to build increasingly complex financial structures. When investors deposit USDC into different DeFi protocols, they receive a tokenized claim representing their position and the yield it earns—such as aUSDC from Aave, SyrupUSDC from Maple, or sUSDe from Ethena. These tokens can then be reused across the ecosystem: they can be traded, staked for additional rewards, posted as collateral to borrow against, or deposited into other yield-generating protocols, unlocking new layers of opportunity through interconnected DeFi “lego blocks.”

This leads us into a DeFi protocol called Pendle, a composability layer, building on top of other DeFi primitives. Pendle can be understood as the DeFi equivalent of a bond desk that takes a single yield-bearing instrument and splits it into fixed and floating yield components. Imagine a traditional bond trader slicing a bond into its principal (zero-coupon) and coupon (interest) streams — that’s essentially what Pendle does for tokenized yield-bearing assets like aUSDC, SyrupUSDC, or sUSDe. When you deposit one of these assets into Pendle, it tokenizes your position into two parts: Principal Tokens (PT), which represent the fixed-value component you’ll receive at maturity, and Yield Tokens (YT), which represent the variable income (the floating yield) that accrues over time.

This structure creates a secondary market for yield. Conservative investors can buy PTs to lock in a known return — analogous to purchasing a zero-coupon bond — while speculative or yield-seeking traders can buy YTs to gain leveraged exposure to future yield fluctuations, similar to holding a floating-rate note. In essence, Pendle functions like a DeFi bond desk, enabling investors to trade, hedge, and arbitrage yield curves directly on-chain. The result is a more efficient yield market — where yield itself becomes a tradable, composable asset, not just a byproduct of holding tokens.

A widely used strategy in DeFi—known as a “loop”—combines protocols like Ethena, Pendle, and Aave to recycle capital in a self-reinforcing cycle that now channels over $4 billion in composable assets. In essence, it functions as a leveraged carry trade, amplifying yields by stacking multiple sources of return. As the ecosystem matures, these connections are expected to deepen further, potentially incorporating new layers such as Hyperliquid, a popular DeFi perps exchange, to expand yield opportunities.

Here’s how the loop operates:

The process begins with Ethena when an investor converts USDC into USDe and stakes it, receiving sUSDe—a yield-bearing stablecoin currently earning around 8% APY.

Pendle then splits the sUSDe into Principal Tokens (PTs) and Yield Tokens (YTs). PTs represent the fixed-value component of sUSDe and are sold at a discount (similar to a T-bill), then redeemed one-to-one at maturity.

Aave completes the loop by allowing investors to borrow against their PT holdings. Because PTs have a predictable redemption structure with little variability in their price, they serve as reliable collateral. Borrowers often use the borrowed USDe to re-enter the cycle—restaking it in Ethena to mint more sUSDe and repeat the process.

In short, Ethena generates the yield, Pendle packages it, and Aave leverages it—creating one of the most powerful and interconnected yield engines in DeFi today, driving the majority of Ethena’s deposits on Aave and a substantial share of Pendle’s total value locked (TVL).

TVL (Total Value Locked) refers to the total amount of assets — typically measured in USD — that are deposited or “locked” into a DeFi protocol.

Effective APYs can reach 15-25% depending on the funding-rate environment (Ethena yield driver), Pendle market discount, borrowing costs, and loop depth. This loop behaves like a leveraged carry trade: borrowing cheap liquidity to finance long exposure to a higher-yielding asset — much like the yen carry trade but without the FX risk.

This loop carries leverage, yield, and smart contract risk. For example, if Ethena’s yield falls or USDe depegs, collateral values drop and loans can be liquidated. Also, rising Aave borrow rates or Pendle price volatility can erase returns. Since it relies on three protocols, any technical or liquidity failure in one can cascade through the system.

Aave and Pendle are both battle-tested protocols with proven track records. Aave, launched in 2017, has evolved through multiple iterations and weathered several crypto bear markets, solidifying its role as a cornerstone of decentralized lending. Pendle, founded in 2021, has grown rapidly to reach over $11 billion in TVL, demonstrating strong market adoption of its yield-trading model. Ethena, by contrast, is a newer entrant and has yet to face a true stress test in volatile market conditions. Over time, as these platforms continue to mature, they are likely to deepen their integration with institutional capital and traditional finance, bridging on-chain innovation with mainstream investment infrastructure.

Looking Ahead

“The most profound technologies are those that disappear.

They weave themselves into the fabric of everyday life until they are indistinguishable from it.”

— Mark Weiser, 1991

There are many consumer facing apps that abstract away the complexity of using DeFi, making access to higher DeFi yields as easy as clicking a button. A couple examples of enhanced yield that will be available to consumers as the industry continues to innovate are provided below:

Wellspring, a consumer finance and crypto-DeFi hybrid app, offers savers the potential for higher yields than traditional savings accounts by converting USD deposits into stablecoins and deploying them into decentralized lending protocols such as Aave. Designed for ease of use, its interface resembles a conventional banking app—users simply deposit USD while the platform manages all underlying crypto and DeFi operations behind the scenes. The company advertises yields of up to 12% APY, though these returns are variable and not guaranteed.

Coinbase, a leading U.S.-based cryptocurrency exchange, serves as a bridge between Traditional Finance (TradFi) and DeFi, combining exchange, custody, and payment services under one brand. Its goal is to act as a “bank replacement” or users’ primary financial account, expanding into savings, lending, and investing. To this end it has applied for a U.S. National Trust Charter, which would give it more latitude to offer payment, custody, and trust services under clearer federal oversight.

Among its current consumer offerings is the Coinbase Visa® debit card, which allows users to spend their crypto (Bitcoin, Ethereum, USDC, etc.) at any merchant that accepts Visa, converting digital assets into fiat at the point of sale. Coinbase also promotes a 4.1% APY reward rate for holding USDC on its platform—a structure that functions as a “reward” rather than formal interest, aligning with restrictions in the GENIUS Act that prohibit stablecoin issuers from paying interest directly to holders.

Although these DeFi alternatives offer higher yields relative to traditional banks, they lack regulatory safeguards such as FDIC or SIPC insurance—meaning funds held in crypto, stablecoins, or yield-generating programs are not protected if the platform fails or is hacked, exposing users to counterparty and systemic crypto risk absent in traditional banking. DeFi loops that amplify yields introduce additional risks such as smart contract vulnerabilities and leverage that can lead to rapid liquidations if collateral values fall.

DeFi’s yield landscape is no longer a niche experiment—it’s an expanding ecosystem that mirrors and often improves upon traditional finance’s most profitable mechanisms. Yet while the rewards can be striking, so too are the risks: smart contract vulnerabilities, collateral volatility, and the absence of FDIC-style protections remind us that higher yield rarely comes without trade-offs. As platforms like Aave, Pendle, and Ethena continue to intertwine, and consumer apps such as Wellspring and Coinbase bring these opportunities to the mainstream, DeFi is steadily weaving itself into the fabric of everyday finance—fulfilling Mark Weiser’s vision of transformative technologies that “disappear” into daily life.

If you encounter a paywall on any of the linked resources, feel free to reach out—I’d be happy to share the full content.

If you found this newsletter valuable, please consider sharing it with others.

Mike Treidl, CFA | Founder & CIO @ Blue Coin Capital

Disclosures & Disclaimers

The information contained in this newsletter is for informational purposes only and does not constitute investment, legal, or tax advice. Blue Coin Capital is an investment adviser that manages digital asset strategies for qualified investors. Nothing herein should be interpreted as an offer to sell, or a solicitation of an offer to buy, any securities or investment products.

Opinions expressed are current as of the date of publication and subject to change without notice. Certain content may reflect the views of Blue Coin Capital and its personnel and may include forward-looking statements that are not guarantees of future performance.

Digital assets, including cryptocurrencies and stablecoins, are speculative and involve a high degree of risk. Past performance is not indicative of future results. Always conduct your own research and consult with a qualified professional before making any investment decisions.

Blue Coin Capital, LLC is a California limited liability company.