Is California Falling Behind in the Bitcoin Reserve Movement?

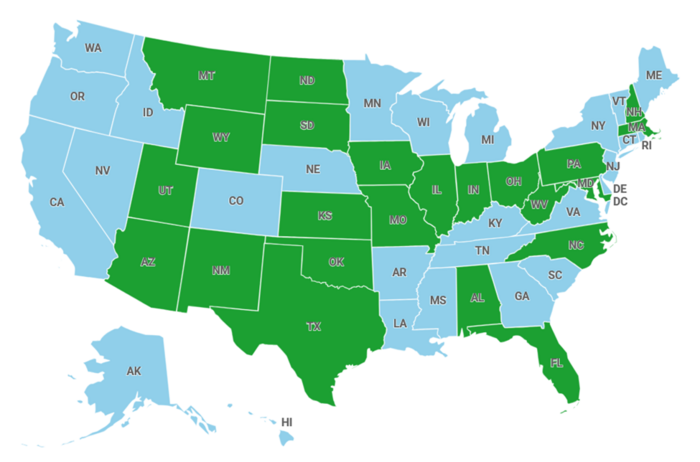

With nearly half of U.S. states actively considering legislation to establish strategic Bitcoin or cryptocurrency reserves, California’s relative inaction raises a critical question: Is the state lagging behind in digital asset adoption?

Currently, California is in the early exploratory stages of such legislation. Assembly Member Phillip Chen, representing Orange and San Bernardino counties, has partnered with Proof of Workforce, a Santa Monica-based nonprofit, to examine how Bitcoin could support and rebuild the state’s infrastructure and communities. Proof of Workforce is no stranger to governmental Bitcoin initiatives—it previously partnered with the City of Santa Monica to open an official Bitcoin office.

Why a State-Managed Bitcoin Strategic Reserve?

The rationale behind a state-run strategic Bitcoin or cryptocurrency reserve varies. States exploring these initiatives cite potential benefits such as hedging against inflation, diversifying public investment portfolios, enhancing long-term returns, and positioning the state as a leader in financial innovation. The term "strategic reserve" in proposed legislation appears to be more of a marketing label than a functional designation, as digital assets would be integrated into state investment portfolios rather than serving the same purpose as national reserves like the Strategic Petroleum Reserve, Uranium Reserve Program, or Helium Reserve.

What These Proposals Entail

Recent legislative efforts in multiple states propose allocating up to 10% of state-managed investment portfolios into digital assets. These funds typically include the state's general fund, rainy day fund, and public retirement funds. However, given stringent market capitalization criteria, Bitcoin is currently the only digital asset meeting these requirements.

States differ in their approach to custody and management. Some plan to hold Bitcoin on-chain—either directly under state control or within a potential federal strategic Bitcoin reserve—while others focus on investing in digital asset ETFs.

Proceeding with Caution

It is important to note that none of the proposed legislation has yet become law. Even if enacted, states would not necessarily allocate 10% of their portfolios to digital assets overnight. In reality, a significant portion of public funds is allocated to cash-equivalent, liquid investments or duration-matching fixed-income portfolios, both of which are unlikely to include digital assets. If incorporated, digital assets would likely fall within a risk-based holdings allocation, alongside equities and commodities like gold or oil.

Potential Impact on Bitcoin and Digital Assets

Despite these uncertainties, the potential adoption of digital assets by state institutions could have far-reaching implications, including increased institutional demand leading to greater market stability and liquidity, legitimization of Bitcoin and digital assets at the highest levels of government, further adoption by other states and even foreign entities if early adopters see positive returns over a market cycle.

As more states explore the feasibility of Bitcoin reserves, California must decide whether to lead in digital asset integration or risk being left behind.

U.S. Map of States Pursuing Strategic Bitcoin Reserve Legislation (In Green)

Disclosures & Disclaimers

The information contained in this newsletter is for informational purposes only and does not constitute investment, legal, or tax advice. Blue Coin Capital is an investment adviser that manages digital asset strategies for qualified investors. Nothing herein should be interpreted as an offer to sell, or a solicitation of an offer to buy, any securities or investment products.

Opinions expressed are current as of the date of publication and subject to change without notice. Certain content may reflect the views of Blue Coin Capital and its personnel and may include forward-looking statements that are not guarantees of future performance.

Digital assets, including cryptocurrencies and stablecoins, are speculative and involve a high degree of risk. Past performance is not indicative of future results. Always conduct your own research and consult with a qualified professional before making any investment decisions.

Blue Coin Capital, LLC is a California limited liability company.